Telecom, the VOIP world and Skype

March 2015

An analysis and prescriptive opinions

The telecommunication industry is a multi-billion-dollar industry that has faced recent changes with the emergence innovative technology companies including Skype. The entry barriers of the telecom industry today are considerably low given a key characteristic that is changing: initial capital investments are much smaller than ever before. As a result, these low entry barriers have given rise to the emergence of new startup companies and Voice over Internet Protocol “VoIP” providers who use the public internet to transmit communications traffic.

The telecom industry is also characterized with low brand loyalty. Customer preference solely depends on network effect, and Skype and other VoIP providers rely on these network effects: the success of their businesses depend upon peer-to-peer network connectivity. Thus, critical mass is vital in this industry and buyers have a considerable level of power. The main suppliers are hardware and software development companies who may choose to exert their power by restricting the use of Skype or a VoIP provider. However, instead of this restriction, collusion takes place because it is more advantageous to both parties.

The main industry players are traditional telecom companies, mobile phone providers, VoIP providers, regulators, and advertising agencies. There are also substitutes for telecom including email, social networks, and international telephone cards.

In a fast-paced industry that revolves around technology, the standard can change in short cycles, as many companies are able to incorporate desirable features by mimicking other platforms. Therefore, a first mover advantage is huge in this business. Additionally, it is typical for internet telephony providers to initially develop features to differentiate themselves from the rest. But, if a company fails to continue to come up with new features to meet consumers’ demands over time, consumers will start using other providers since switching costs in this sector are minimal.

Skype possess characteristics of one-sided market as it connects only one type of customer who both makes and receives calls. However, since advertisers are also a significant part of the model, their presence could transform Skype into a two-sided market from this perspective. Overall, Skype is a generalist platform that focuses on enlarging its network effect.

Given the emergence of the VoIP providers and Skype, it can be concluded that the overall attractiveness of the telecom industry is reducing rapidly, and that critical mass is imperative for business sustainability.

Skype vs Telecom Carriers

Prior to 2003, telecom companies benefitted from high profit margins as consumers could only access long distance calls from mobile phones and landlines. The typical phone contract was either a monthly subscription with high pay-as-you-go prices for international calls, or a monthly package.

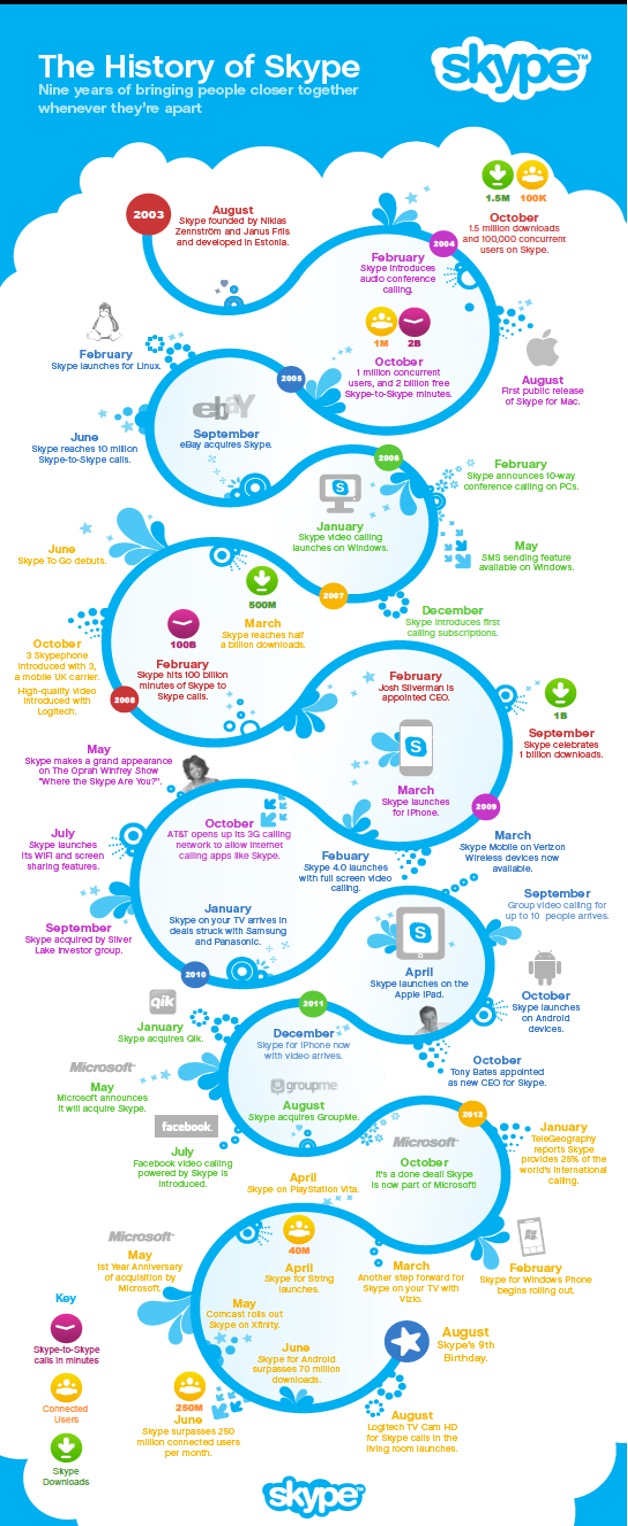

In 2003, Skype impacted the telecom industry by introducing a disruptive technology together with revolutionary service: internet telephony or VoIP combined with free computer to computer calling that dramatically reduced the price of international phone calls. This began a new standard war. Skype generated revenue through pay-as-you-go, monthly subscriptions and extra service charges for calling landlines and mobiles. Another revenue source was through third-party advertisements, to which non-paying Skype customers are exposed.

Since Skype originally was a free peer-to-peer based platform, its model relied heavily on network effects. Providing free calls was a way to generate call volume and to attract potential customers to increase the network effects. Skype’s entrance and network effects, along with human behavioral evolution, caused a threat to traditional offline companies and their business sustainability.

Since Skype’s entrance, there have been revenue losses for telecom companies of up to $386 billion. Since 2010, more than 100 million copper phone lines in the United States have been disconnected and companies like AT&T will abandon landlines altogether by the end of the decade. Skype forced telecom operators to find alternative revenues by developing and charging for high-speed internet connections for existing peer to peer platforms. The resulting response from the offline telecom companies has created a potential oligarchy in the internet, which also raises barriers of entry to potential new entrants. Over the same period of time, however, mobile companies were able to grow their customer base and provided compatibility with Skype in devices. Even so, Skype is almost 40% of the international telecom market today.

Some governments have tried to protect their telephone monopolies by banning Skype from entering the market even on a computer-to-computer basis. Companies also reacted: in Spain (2010), Telefónica purchased a VoIP network in order to undermine Skype. In Italy (2011), Eutelia successfully lobbied to public authorities while Skype was not able to reach an agreement.

Skype and Other Voice Calling Platforms

When Skype created the new communication standard war, the system was characterized by an incompatibility with telecom companies: it was not possible to call from telecom to Skype. However, there were no switching costs for moving from telecom to Skype. In terms of competition and substitutes when Skype entered the market, there were no competition for VoIP calls and substitutes were limited to the same forms of communication as in the traditional telecom industry.

Since its onset with Skype, the standard war has been taken over by intense competition. Skype was not the only company to benefit from the growth of smartphones: since 2010, many new entrants such as Viber, Google Voice, Line, Snapchat, Whatsapp, and FaceTime have launched into the market and are Skype’s main competitors and communication substitutes. The increased competition leads to a multi-homing effect since consumers are able to use several platforms at the same time. But, Skype does not seem to suffer that much from the competition: Skype to Skype international traffic grew 36% in 2013. Skype’s success has been achieved given that its very well established brand that originally captured the install base through its first mover advantage.

While characteristics of a new standard war among the competitors are not present, new communication behaviors have appeared. For instance, today, we do not necessarily communicate with others live; we may leave a voice memo or video message instead. To combat the threat of its competitors in the future, Skype needs to improve its competitive advantage through a differentiation advantage since all of the services offered by its competitors are free. To do so, Skype should continue with what Microsoft is attempting to do: engage in cloud technology, leverage its large user base, and make investments in infrastructure. These will attract and extend cloud telephony service to large businesses and companies versus to just individual users. Not only will this add to its differentiation strategy, but it is also a way to change the rules of the VoIP game into a new game at the business level. Further, it will continue to propel Skype’s install base. Backed by Microsoft, Skype can also improve the quality and reliability of its services. In such a context, encryption advances are a way to create a new standard and keep leadership in the market. Beyond technology, Skype-Microsoft could also develop and reinforce its lobbying efforts for favorable and protective regulation to help secure its efforts in differentiation and international presence.

Acquisition by Microsoft

In 2011, Microsoft acquired Skype for $8.5 billion in cash was largely seen as:

● Access to New Market – Microsoft only had participation in the IP-IP voice calls market, and it lacked the broad coverage offered by traditional lines. Skype has shown expertise in integrating the two platforms and profited from this integration, something that Microsoft could not do with their own services. This new market provides Microsoft a new revenue channel that can be expanded if capitalized within their mobile phones segment.

● Access to Paying User Base - Skype’s total user base and 6.5% paying user base . Microsoft had a larger user base with its own voice call services but none of them paid. Microsoft has struggled to profit from its user base while Skype has profited. Microsoft needs these paying customers as a starting point to begin profiting, and they will potentially provide more value in their products as well by integrating Skype services.

● Defensive Move against Facebook and Google who were said to be earlier dance partners for Skype. While this is true, the move also increases bureaucracy. Acquisitions add costs in terms of overhead, merger supervision, and new structuring costs. Furthermore, in order to take full advantage of Skype’s value, Microsoft must merge both gigantic user bases, which is a huge undertaking in terms of investment, development, and user loyalty maintenance.

● Synergies & Recommendations - Skype’s peer-to-peer video chat quality is better than the previous Microsoft alternatives and should be exploited. Also, the integration could serve to boost the declining Hotmail service by offering direct voice or video calls. If Microsoft successfully merges the Skype video chat with their own, the revenues could grow exponentially. Skype services should be merged with the Microsoft professional suite to provide new alternatives and better performance for business use, and thus increase the profits from this segment. Next, Microsoft should develop a “Skype-based” technology to integrate with its smartphone segment, in order to provide a worldwide VoIP service that could revolutionize the region-focused mobile market.

One question remains: is Skype worth more inside Microsoft than as an independent firm? Since the potential synergies and markets for the combined company far exceed the cost of merger bureaucracy, the acquisition was a good move for Microsoft. While Microsoft does not publish separate financial results for Skype, Skype has seen its user base increase to 250 million people, up to 26%, in only seven months . In addition, the number of call time minutes in the first quarter of 2012 was 40% higher year over year. But, Microsoft paid 32 times Skype’s operating profit, without taking into account Skype’s net loss of $7M in 2010. In summary, although Microsoft can monetize this acquisition in the long run, the price paid for it was unreasonable high. In the end, Skype was the big winner.

In summary, Skype-Microsoft should focus on their differentiation advantage. To do this, they should develop their cloud telephony, turn their historical weakness of security into being the encryption leader, and leverage the Microsoft Office suite that businesses are already using to become the main professional leader. In this way, Skype will increase their paying user base and profitability, and will renew Microsoft’s business presence. Skype will accommodate other VoIP providers, but it will not pressurize Skype as they will have changed the rules of the game and have entered a better one.