Shifting trends in IPO interests

August 2024

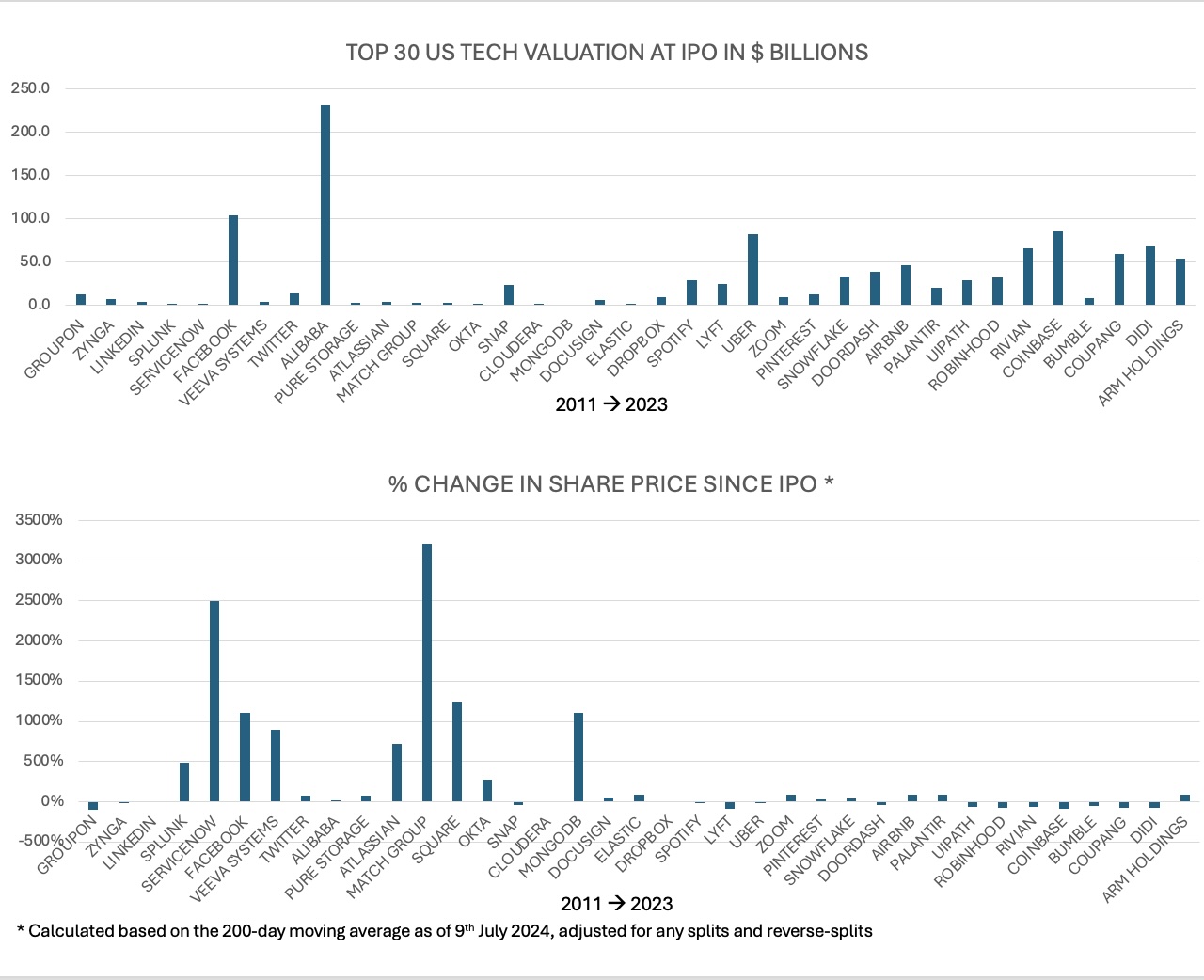

Brewing behind the scenes of wealth and value creation in American tech IPOs is a profound shift in its investment patterns. The valuations of the top 30 tech IPOs that averaged at $5.4 billion between 2010 - 2015 increased over twofold to $11.4 billion for the period 2016-2021.

What meets the eye

An increasing number of startups are being grabbed by private investors who retain them throughout the period of their steep growth trajectory, seemingly withholding a good portion of their upside potential from public benefit. Prima facie, it may seem that Private Equity, that typically comes in after prospects in startups start surfacing post their seed-funding by Venture Capitals thereby entering into series A,B & C funding stages to steer the novice entity’s expansionary aspirations, is the reason for the stealthy push back of public access to these valuable equities until most of their growth prospects are milked, leaving behind very little for retail investors to reap and thus diminishing the promise of public-prosperity that initial equity offerings used to offer in the preceding decades.

The imperative of risk vs. return

Dug deeper, this initial impression may be easily dismissed from being worrisome, as the very difference between private and public equity is the control aspect. While majority shareholders do get voting rights in board meetings, it is incomparable to the level at which private equity board nominees take charge of the daily operational decision making to power-up the company’s potential and navigate it into profitability quicker. That may be the reason why unicorns like Uber and AirBnB were operational in 63 and 220 countries and regions respectively at the time of their IPOs as a result of the wisdom and experience of their private owners such as TPG, Silver Lake Partners and Sequoia Capital. The optimizations of their treasuries, the efficiencies in their operations, the sophistication in their marketing, the farsightedness in their people strategies centering around the quintessential formidability in their product performance were no second to any multinational of fortune 100 status. The harvest of high returns from equity ownership, prior to releasing for public access comes with the assumption of a commensurate proportion of risk involved, something that only the professional management of it can possibly mitigate. And by its innate nature the market rewards this contribution to value creation by recognizing the facilitators of the grand success of such startups by distributing tangible and competitive remuneration.

The cautionary conclusion

In 2023, the only other people competing with founding and nurturing tech CEOs in their compensations were PE leaders. The Lehman shock episode being still very much alive in the memories of the ruling generation, the world of alternative investments always carries the responsibility of not exhibiting flamboyance in its celebrations of success. It only takes a single market jolt to awaken the ire of the middle class when a looming crisis of any nature begins to challenge its survival. And in every market cycle when that eventuality realizes, the controllers of such immense world wealth will yet again be made to stand in the box and publicly questioned for their decisions, much like the banking leaders were made to explain and thereafter penalized after the previous market collapse of 2008. The age old habit of the general populace in crying foul when the going gets rough is never to be forgotten and is sure to usher in strict controls in a hitherto unregulated space of private investments.