Brief: Transaction Banking in Review

August 2024

The world’s second oldest profession has been challenged for sometime now by digital disruptors. The 2008 meltdown serving as the triggering cornerstone, global banking in all its functions of lending, payments and investments now shares its revenues with Financial Technology (FINTech) companies, who are far more flexible in continuously updating their processes and technologies partly because of operating under more relaxed regulatory obligations, but mainly because of negligible inertia they carry of thought and movement that the banking incumbents often find hard to break out of. And yet, banks continue to perform their spinal duties to bolster economic advancement through newer and sophisticated techniques of capital-flow.

An integral part of long-standing, traditional corporate banking includes the working capital management for enterprise treasuries. In the last decade most of the American banks segregated this business from the then integrated securities custodian business, transitioning from their previous branding of Transaction Banking (or Services) into a more focused Treasury and/or Trade Services. That has started changing again and in the last reporting period, some banks are restoring the estranged sibling of securities custodian business alongside the treasury services business and are now integrally serving their clients’ cash management, trade finance and securities management needs through this overarching banking services business. This essay though has not scoped in the securities custodian business and in the ensuing content Transaction Banking (TB) refers to the cash management and trade services part of the business only.

The Business Context

The common thread between the success of Amazon paying its Chinese sellers the prices for goods that it collected from customers in the UK, or the US Social Security Administration, paying the pensioners their monthly dues in Japan, or the United Nations Paying its employees in Russia or an Alternative Investment Fund handing out returns to investors in Singapore is that all of the enterprises need swift and easy global payments solutions. While tech-savvy FINTechs are adept at making payments seamlessly, the difficult part, as an example, of issuing the necessary Letter of Credit for goods to smoothly transition between ports is still very much exclusively a banking function. And when similar rudimentary functions for the facilitation of global trade are yet managed by banks, enterprises prefer to have cash accounts with their global banking partners in every country of their operations. For preferred clients, banks bundle these services with some creativity in consolidating and managing an optimal amount of liquid cash in their operating accounts by offering discounted charges and/or higher returns from short-term low-risk investment instruments. From the bank's perspective, this is a good source of funds for maintaining the Basel liquidity ratios. Seen from the enterprise’s point of view, the Corporate and Investment Banking (CIB) arm of a banking institution’s integrated solutions of providing investment services such as M&As, lending services such as loan syndication of large financing projects and treasury services such as working capital management is a convenient consolidation of all its banking needs and so whilst the notion of banking as a sector is challenged, the business is indispensably ubiquitous in the daily functioning of the world economy.

Customers, Revenues & Expenses

The CFO’s prerogative being the holistic financial health of the enterprise including managing external risk such as rates and FX, the Corporate Treasurer in the CFO’s office is the direct client of the Transaction Banking business. As for any product line, banks typically classify their clients into segments of Energy Services, Technology Media Telecom, Public Sector, Financial Institutions, Transportation & Logistics etc. as the operating capital needs for each sector varies. Because of the lucratively growing category of Small and Medium Enterprises (SME) globally through increasing support from government administrators, all such clients are in a category of their own regardless of the nature of their business. The revenue streams fall into two broad categories of transactional fees and Net Revenue From Funds (NRFF), the latter being sensitive to interest rate fluctuations and contribute to the seasonality of this business besides the variations in the volume of global trade and transactions as affected by geopolitical, macroeconomic and natural calamities. Business operations and technological investments are the biggest expenses and efficiencies through economies-of-scale in those enablers are the key driving factors towards profitability. Network charges by SWIFT and the domestic and international clearing networks of major currencies also impact the bottomline, albeit to a lesser extent.

Product Lines

Aligned with the Corporate Treasury, the cash management product lines serve the Accounts Payables, Accounts Receivables, Liquidity optimization tools and techniques like physical & notional pooling, invoice netting between subsidiaries, interest rate optimization on tiered account balance thresholds, all with the Treasurer’s ultimate objective of a healthy cash conversion cycle. Because international payments make several hops on financial institutions before reaching the end payee, most global banks, white-label their hop services as correspondent banking, charging smaller, regional banks for using their network capabilities. The trade and supplier finance product lines offer ready discounted financing of goods and services throughout the supply-chain, often basing its terms on the enterprise’s credit worthiness. The annexation of corporate cards, a portion of the cards business, is also in alignment with the treasurer’s responsibility of managing operational expenses and is thus included here. Project finance by quasi-governmental lending agencies like the US Export-Import Bank (EXIM) or the European Bank for Reconstruction and Development (EBRD) or Japan Bank for International Cooperation (JBIC) is often structured in tranches alongside commercial banks and the originating business of such loans is also supplemented in Transaction Banking as Agency Financing by most institutions.

Performance of the incumbents

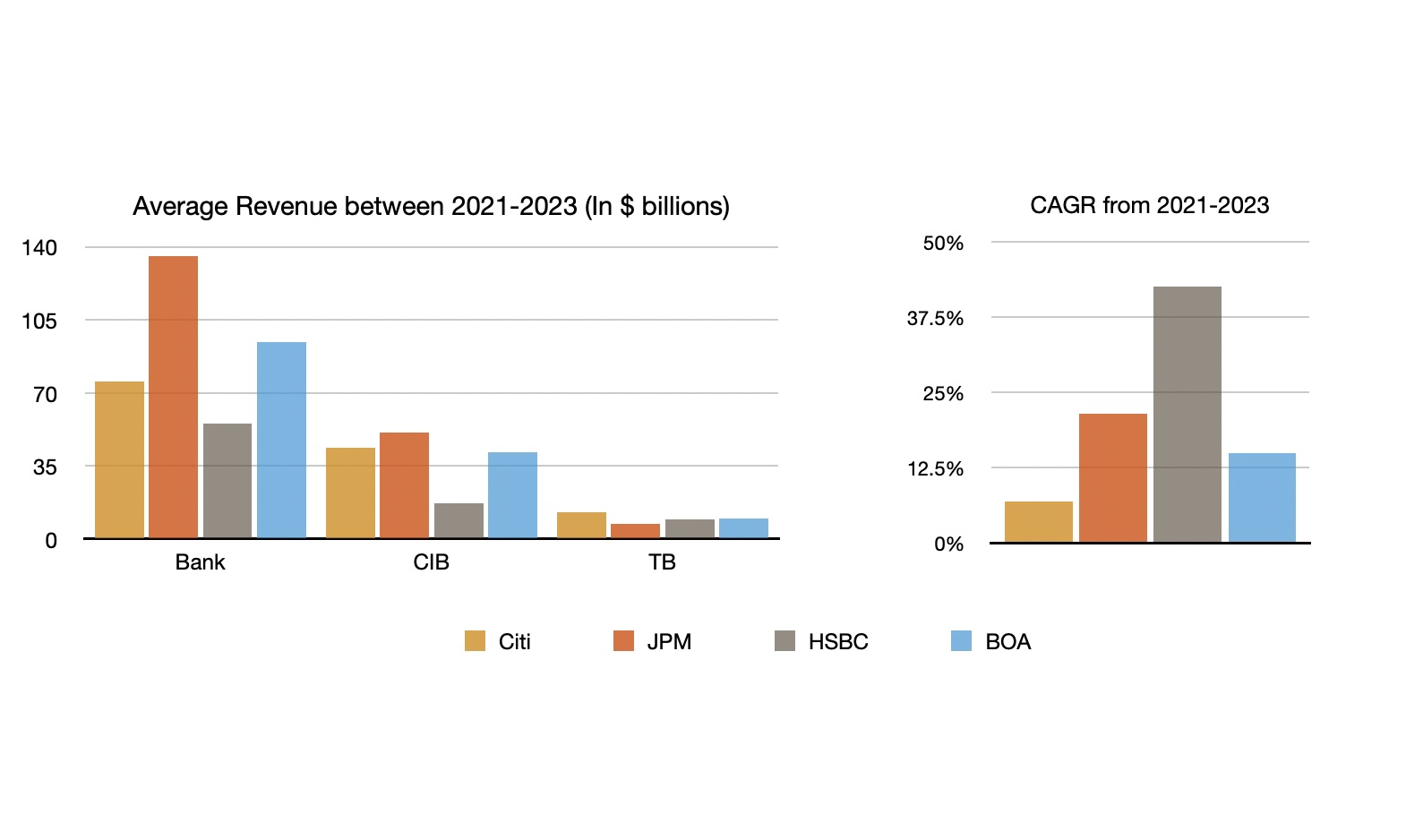

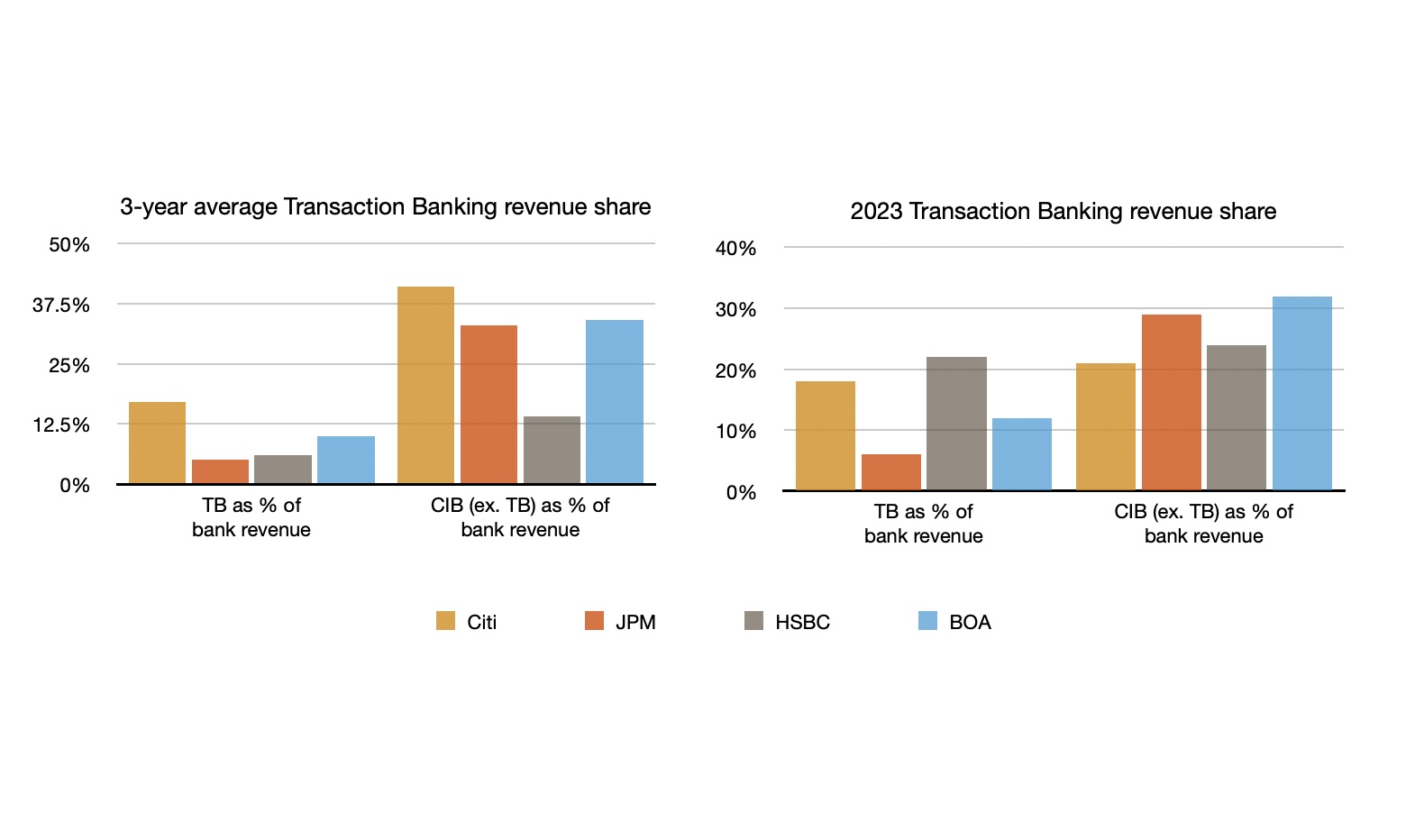

With that context being set, some insights may be drawn by the juxtaposition of the publicly available post-pandemic 3-year financial data of some of the leading players in this space - JP Morgan, Citi, HSBC and Bank of America. All of these institutions have been in the business for decades and sometimes centuries. The investor favorite among banks, Goldman Sachs only entered this space in 2019. Most of these banks serve only the largest global corporations, financial institutions and public sector entities and so having the strongest global presence, Citi’s TB business is the biggest with a 3-year average revenues of $12.67 billion and average Net Income of $2.97 billion. BoA’s Global Transaction Services that serves both its Global Corporate Banking and Global Commercial Banking businesses is a close second with total average revenues of $9.77 billion followed by HSBC with average revenues of $9.38 billion in its GTS business that includes Global Trade and Receivables Finance, Global Payments Solutions under the overarching business of Global Banking. When it comes to growth at a breakneck pace, HSBC’s GTS revenues have grown from $4.97 billion in 2021 to $14.97 billion, resulting in a CAGR of a whopping 42% in 3 years while JP Morgan’s Payments business has grown from a $5.2 billion to $9.3 billion recording a remarkable 3-year CAGR of 21.3% indicating that the bank has put its massive 3-year average revenues of $135.5 billion to good use.

At Citi, the business is serving as a cash-cow where in 2023 the Services division, inclusive of the securities custodian portion, reported contributions of $4.6 billion of Net Income in comparison with the other units of CIB combined that contributed $4.02 billion to the bank’s overall profits. In these times of higher interest rates, its value proposition is predominantly that of a transaction bank.

Closing thoughts

With commoditized product lines offered by these mega-institutions, the differentiation is only achieved through a wise and efficient employment of technology to supercharge the product capabilities. Engineering in banks is unanimously treated as an expense center and it could be in the interest of engineering excellence that the function be outsourced. Almost every bank spends a billion annually on technology and hungry startups could do a stellar job with that magnitude of spending. Manning business operations at this day of AI is embarrassing and so remaining sensitive to job creation, training the operations staff on agile product ownership and transitioning them on to it could expedite the path to AI-nirvana. It is safe to assume that this long-standing business is here to stay, but differentiating oneself does require bold leadership that can inspire radical changes.